Printable Schedule C Worksheet

Printable Schedule C Worksheet - Go to www.irs.gov/scheduled for instructions and the latest information. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Partnerships must generally file form 1065. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Includes recent updates, related forms, and instructions on how to file. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if 4/5 (125 reviews) Partnerships must generally file form 1065. For instructions and the latest information. Schedule c (form 1040) department of the treasury internal revenue service. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships generally must file form 1065. Includes recent updates, related forms, and instructions on how to file. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service. Schedule c (form 1040) department of the treasury internal revenue service. Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Partnerships must generally file form 1065. 30,000+ requests a dayhire the right. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Partnerships must generally file form. An activity qualifies as a business if Partnerships must generally file form 1065. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships must generally file form 1065. An activity qualifies as a business if your primary purpose for engaging in the activity is for. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships must generally file form 1065. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Go to www.irs.gov/schedulec for instructions and the latest information. Includes recent updates, related forms, and instructions on how to file. Partnerships must generally file form 1065. An activity qualifies as a business. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. For instructions and the latest information. Schedule c (form 1040) department of the treasury internal revenue service. 30,000+ requests a dayhire the right procompare top pros Schedule c (form 1040) department of the treasury internal revenue. Partnerships must generally file form 1065. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Go to www.irs.gov/schedulec for instructions and the latest information. 30,000+ requests a dayhire the right procompare top pros Partnerships must generally file form. Partnerships must generally file form 1065. Go to www.irs.gov/schedulec for instructions and the latest information. 30,000+ requests a dayhire the right procompare top pros An activity qualifies as a business if Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service. Partnerships generally must file form 1065. For instructions and the latest information. Go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. An activity qualifies as a business if Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. An activity qualifies. An activity qualifies as a business if Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Go to www.irs.gov/schedulec for instructions and the latest information. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Partnerships generally must file form 1065. Schedule c (form 1040) department of the treasury internal revenue service. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Includes recent updates, related forms, and instructions on how to file. Go to www.irs.gov/schedulec for instructions and the latest information. 30,000+ requests a dayhire the right procompare top pros Schedule c (form 1040) department of the treasury internal revenue service. For instructions and the latest information. Partnerships must generally file form 1065. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Partnerships must generally file form 1065. Schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information.Schedule C In Excel Format

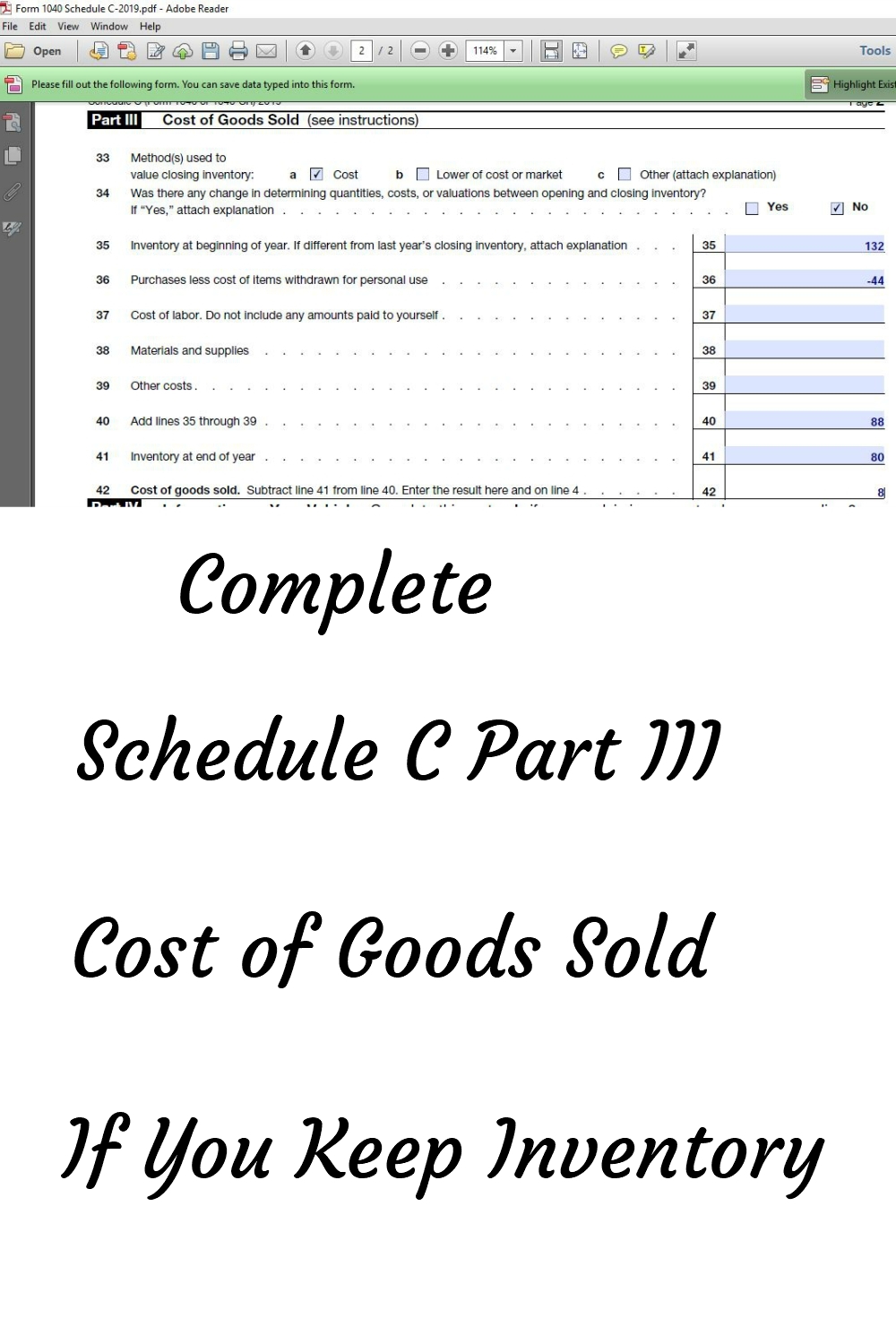

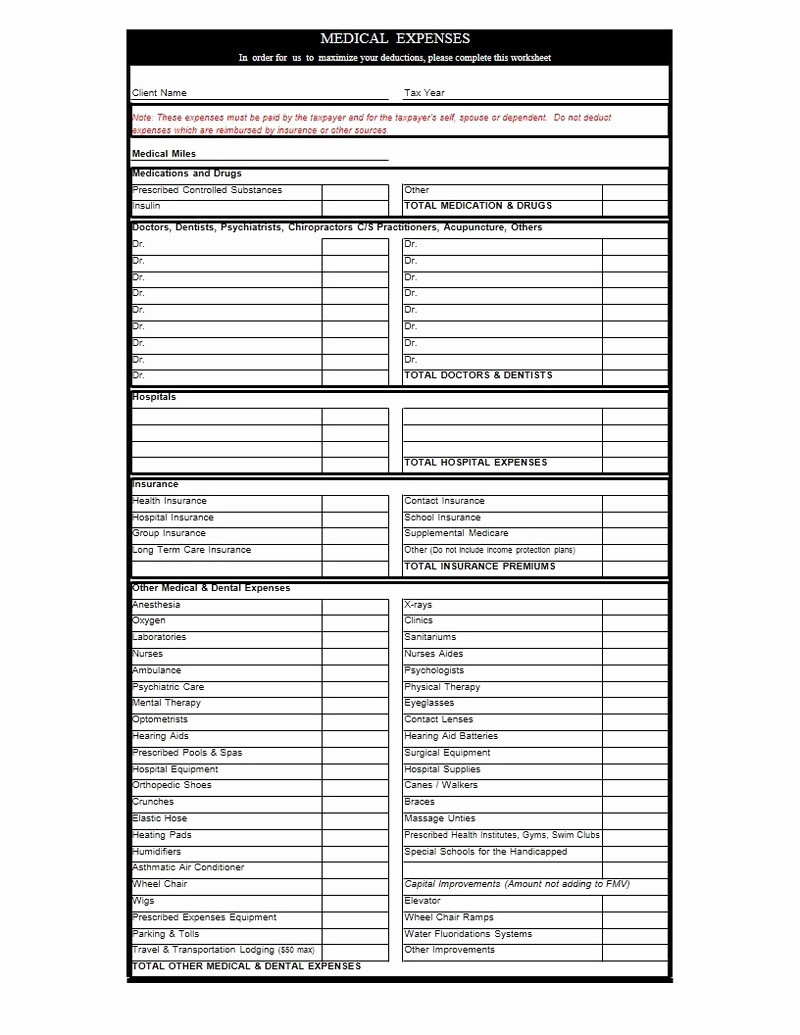

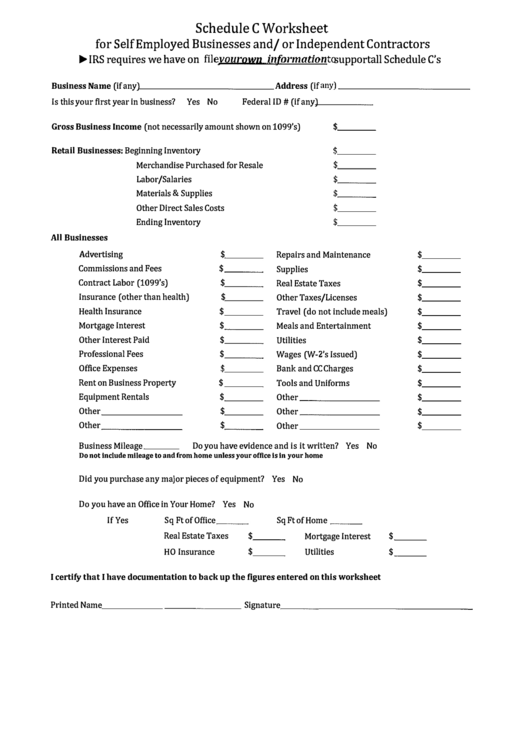

Fillable Online Schedule C Worksheet for Self Employed Businesses and

1040 Spreadsheet with regard to Schedule C Expenses Spreadsheet Then

Fillable Schedule C Worksheet For Self Employed Businesses And/or

Schedule C Worksheet Excel Printable And Enjoyable Learning

Printable Schedule C Worksheet

FREE 9+ Sample Schedule C Forms in PDF MS Word

Schedule C Calculation Worksheet

Schedule C And Expense Worksheet

Fillable Online Schedule C Worksheet.docx Fax Email Print pdfFiller

Use Schedule C (Form 1040) To Report Income Or (Loss) From A Business You Operated Or A Profession You Practiced As A Sole Proprietor.

An Activity Qualifies As A Business If

4/5 (125 Reviews)

Go To Www.irs.gov/Scheduled For Instructions And The Latest Information.

Related Post:

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)