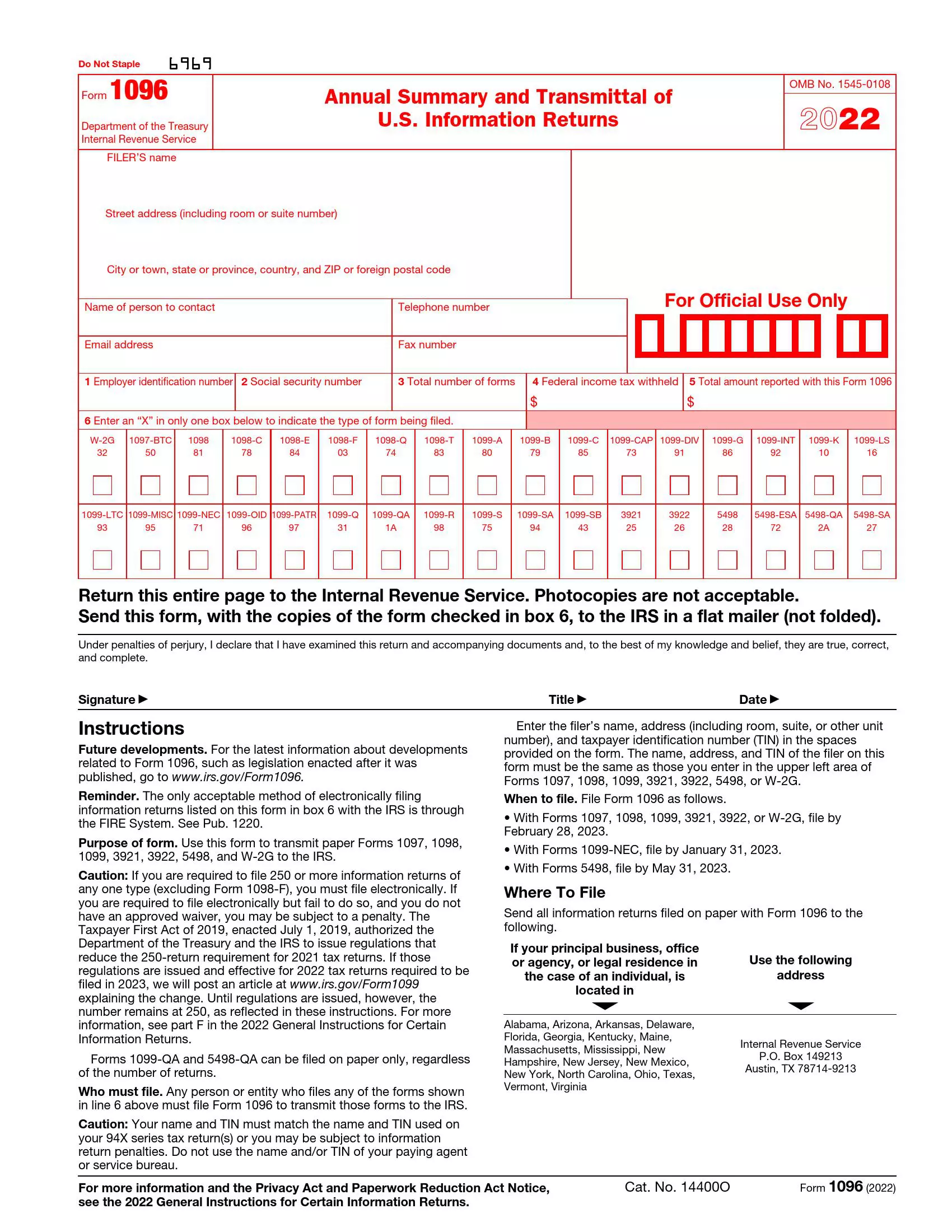

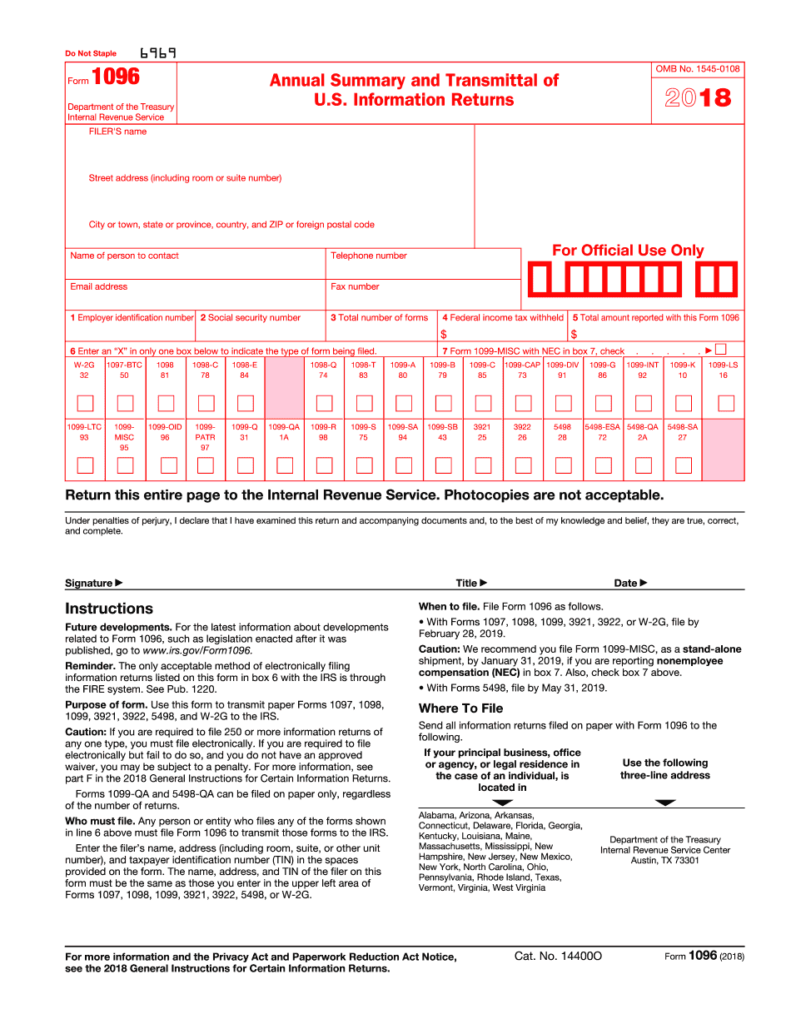

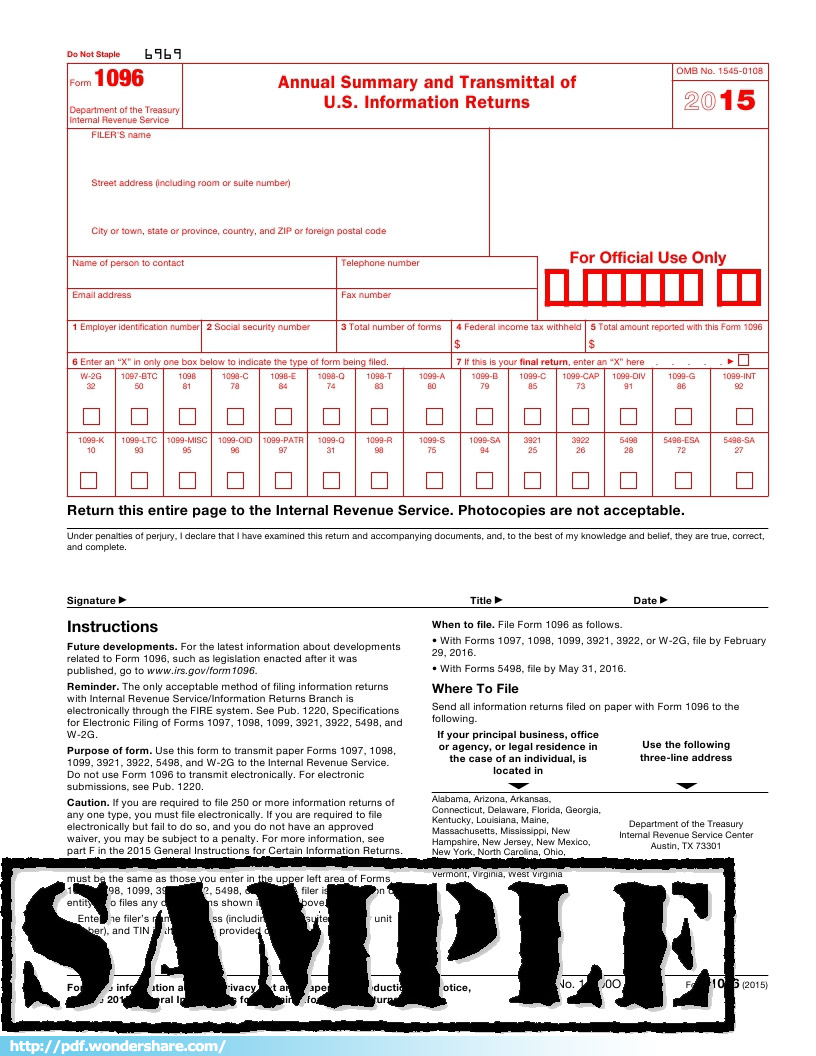

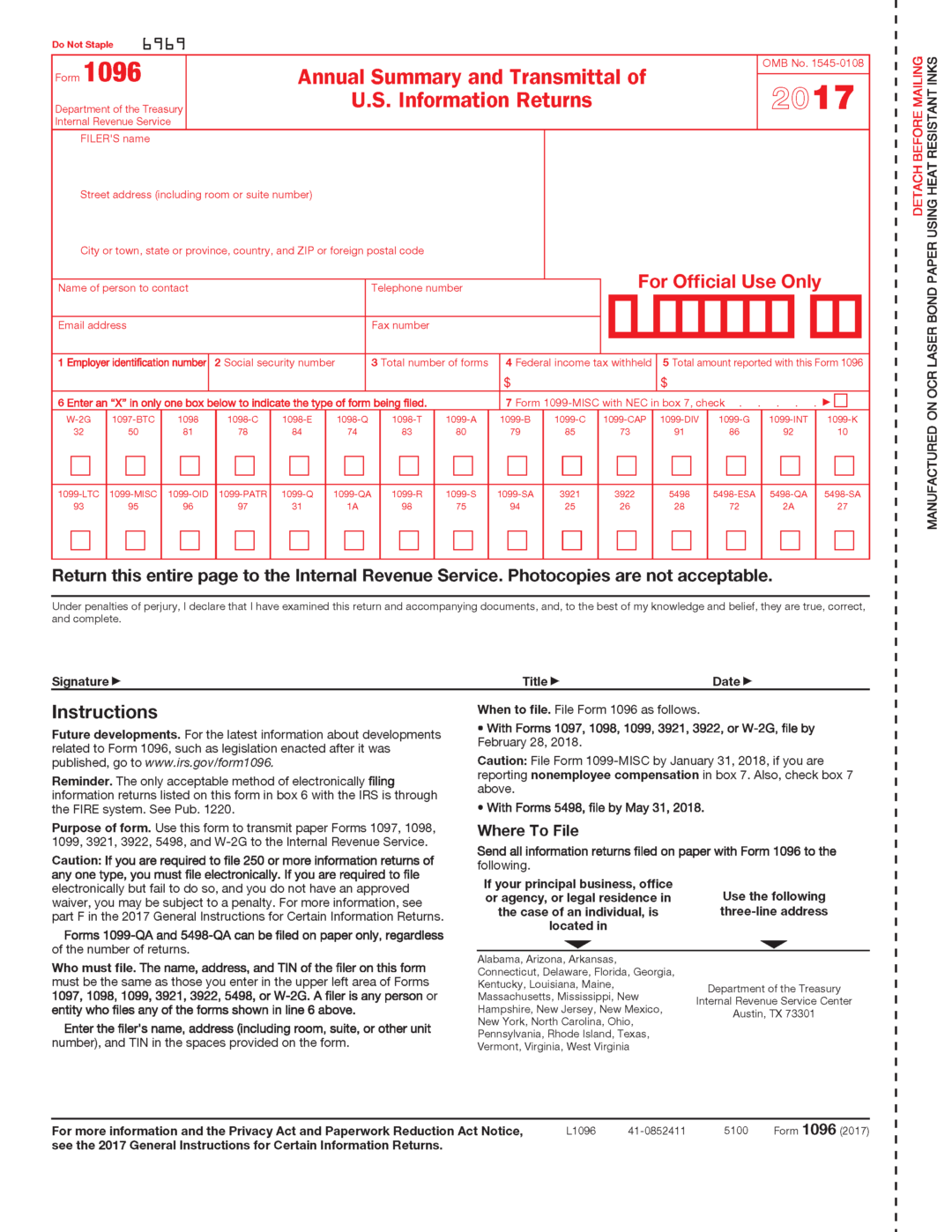

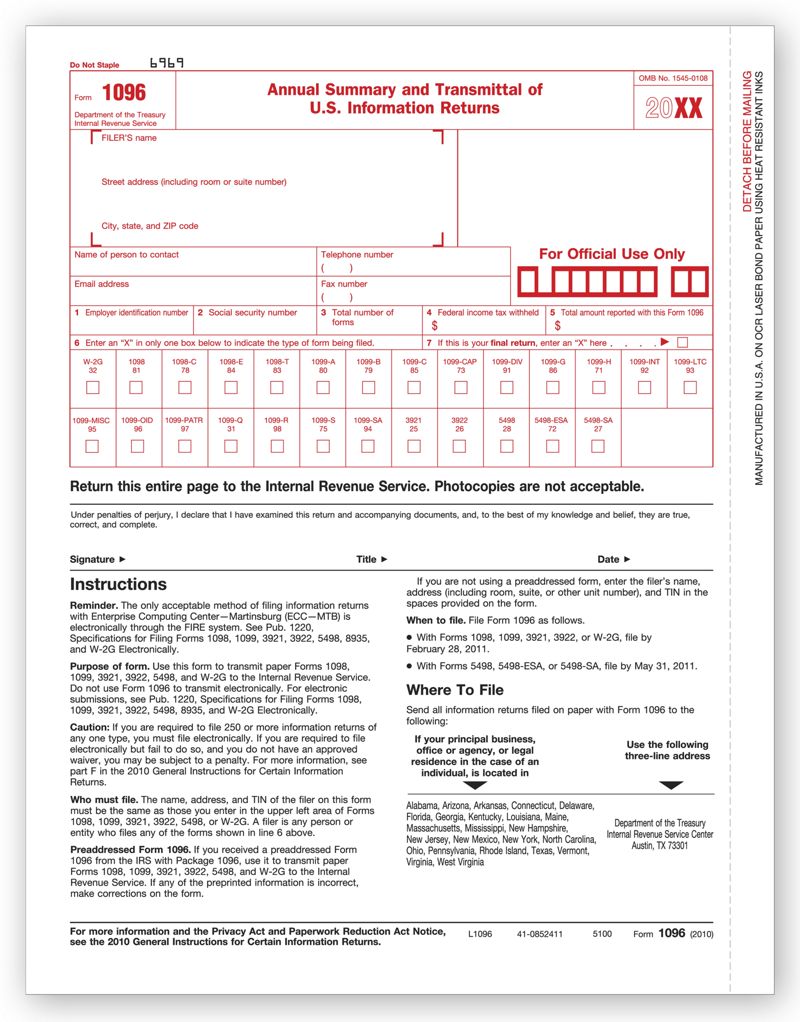

Printable 1096 Form

Printable 1096 Form - It is better known as an annual summary and transmittal of us information returns. We will update this page with a new version of the form for 2026 as soon as it is made available by the. Do not print and file a form 1096 downloaded from this website; A new 1096 form is required when errors are found in the original submission. These errors might include incorrect totals or mismatched information between the 1096 and the. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. Up to $32 cash back form 1096 is one of many documents that require the attention of small business owners during tax season. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Do not print and file a form 1096 downloaded from this website; Form 1096, the annual summary and. Efilers, select “print onto a blank sheet” to create electronic or hard copies for your records. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. A new 1096 form is required when errors are found in the original submission. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Form 1096 is used when you're submitting paper 1099 forms to the irs. See part o in the current. This form is for income earned in tax year 2024, with tax returns due in april 2025. File form 1096 in the calendar year following the year for which the information is being reported, as follows. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. A. See part o in the current. Also known as the annual summary. These errors might include incorrect totals or mismatched information between the 1096 and the. Form 1096 is used by. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. A new 1096 form is required when errors are found in the original submission. Efilers, select “print onto a blank sheet” to create electronic or hard copies for your records. The following article provides instructions on printing 1099 and 1096 forms in quickbooks who need to file their forms with the irs as well as information on where to. File. Form 1096 is officially titled the “annual summary and transmittal of u.s. However, while you can download and print form 1096 for informational or preparation purposes, the irs requires the. See part o in the current. These errors might include incorrect totals or mismatched information between the 1096 and the. Also known as the annual summary. See part o in the current. Do not print and file a form 1096 downloaded from this website; File form 1096 in the calendar year following the year for which the information is being reported, as follows. We will update this page with a new version of the form for 2026 as soon as it is made available by the.. See part o in the current. Up to $32 cash back form 1096 is one of many documents that require the attention of small business owners during tax season. See part o in the current. Efilers, select “print onto a blank sheet” to create electronic or hard copies for your records. The following article provides instructions on printing 1099 and. See part o in the current. Also known as the annual summary. See part o in the current. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. This form is for income earned in tax year 2024, with tax returns due in april 2025. Business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system.the iris. This form is for income earned in tax year 2024, with tax returns due in april 2025. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. Information about form 1096,. See part o in the current. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. A new 1096 form is required when errors are found in the original submission. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. Information returns, including recent updates,. However, while you can download and print form 1096 for informational or preparation purposes, the irs requires the. Form 1096 is used by. File form 1096 as follows. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. These errors might include incorrect totals or mismatched information between the 1096 and. Efilers, select “print onto a blank sheet” to create electronic or hard copies for your records. Form 1096 is officially titled the “annual summary and transmittal of u.s. It is better known as an annual summary and transmittal of us information returns. A new 1096 form is required when errors are found in the original submission. Do not print and file a form 1096 downloaded from this website; This form is for income earned in tax year 2024, with tax returns due in april 2025. Yes, form 1096 is available as a free download on the irs website. If you are filing electronically, form. These errors might include incorrect totals or mismatched information between the 1096 and the. Information about form 1096, annual summary and transmittal of u.s. A penalty may be imposed for filing with the irs information return forms that can’t be scanned. The following article provides instructions on printing 1099 and 1096 forms in quickbooks who need to file their forms with the irs as well as information on where to. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. See part o in the current. Up to $32 cash back form 1096 is one of many documents that require the attention of small business owners during tax season. File form 1096 in the calendar year following the year for which the information is being reported, as follows.IRS Form 1096 Download Printable PDF or Fill Online Annual Summary and

IRS Form 1096 ≡ Fill Out Printable PDF Forms Online

2018 2019 IRS Form 1096 Editable Online Blank In PDF Printable Form 2021

1096 IRS PDF Fillable Template 2023/2024 With Print and Clear Buttons

Irs 1096 Fillable Form Printable Forms Free Online

IRS 1096 Form Download, Create, Edit, Fill and Print

Irs Form 1096 Fillable Universal Network

Fillable Form 1096 Edit, Sign & Download in PDF PDFRun

Printable Form 1096

Printable Form 1096 Form 1096 (officially the annual summary and

See Part O In The Current.

Do Not Print And File A Form 1096 Downloaded From This Website;

A Penalty May Be Imposed For Filing With The Irs Information Return Forms That Can’t Be Scanned.

Also Known As The Annual Summary.

Related Post: