Goodwill Donation Form Printable

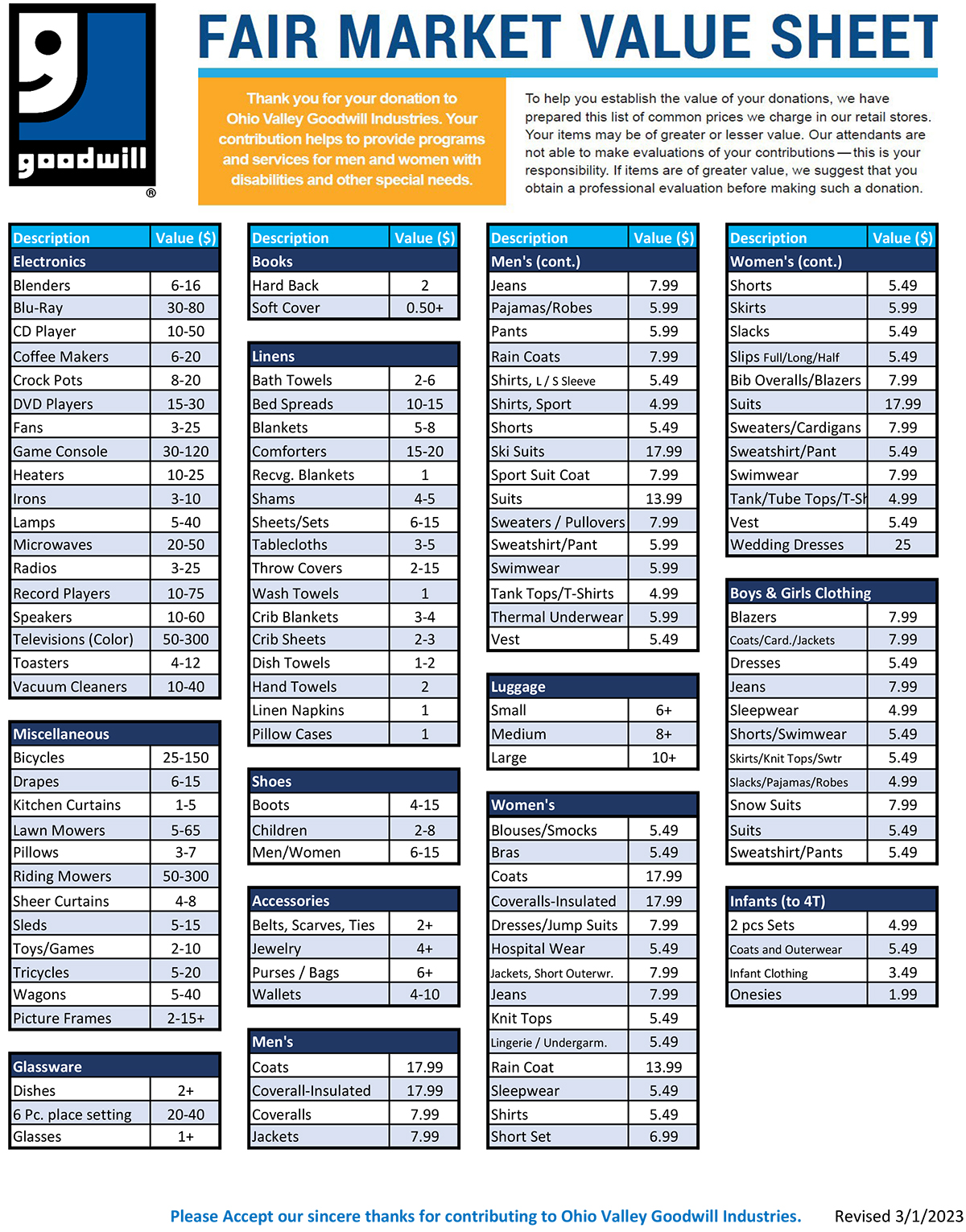

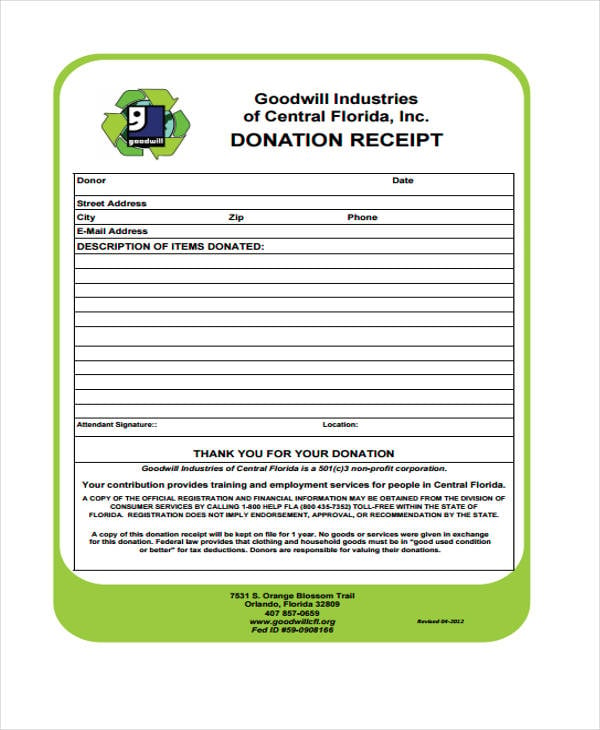

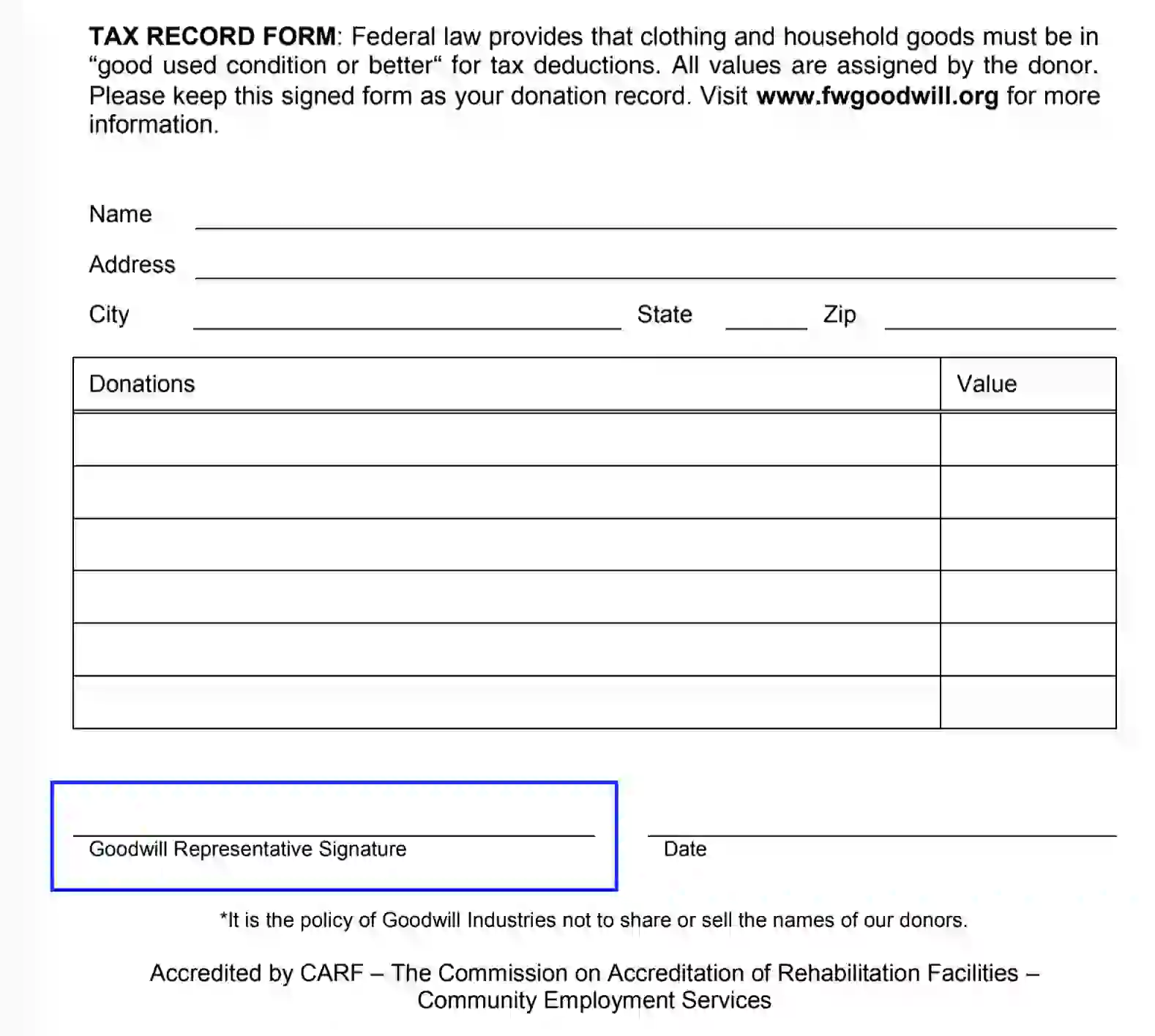

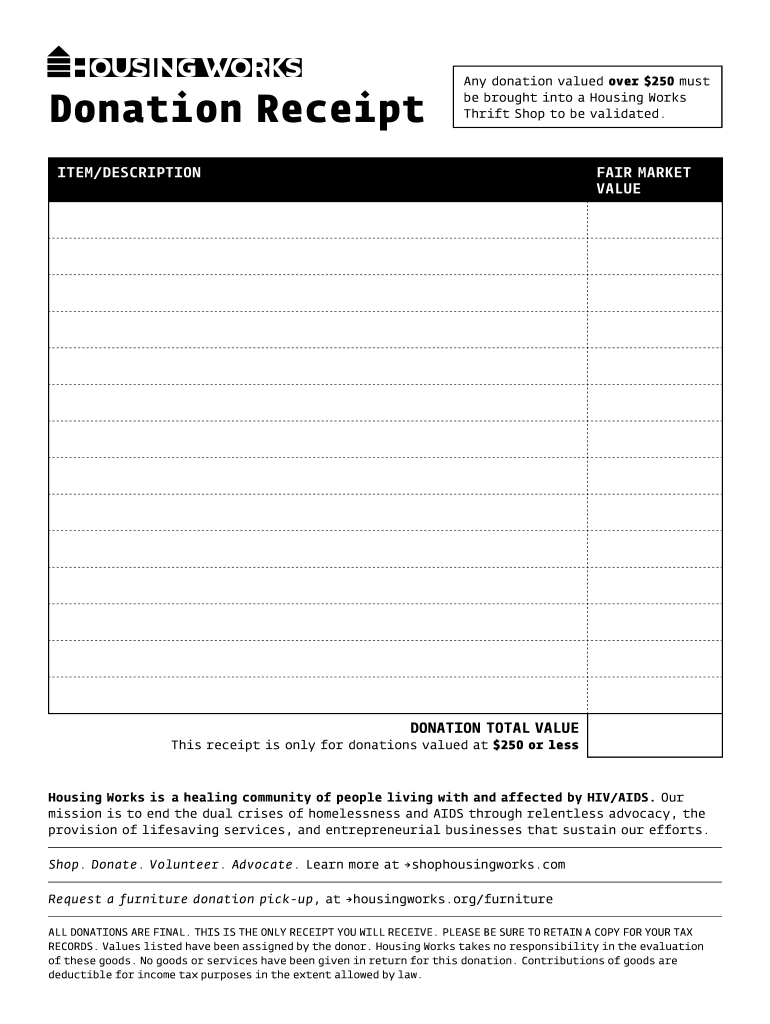

Goodwill Donation Form Printable - Internal revenue service, establishing a dollar value on donated items is the responsibility of the. It includes essential instructions for donors on how to fill out the. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. You should use this form when planning to donate items to goodwill for tax deduction purposes. Use this receipt when filing your taxes. To help guide you, goodwill industries international has compiled a list providing price. Internal revenue service (irs) requires donors to value their items. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. A donor is responsible for valuing the donated. It provides a method to estimate the value of your donated goods accurately. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. Internal revenue service (irs) requires donors to value their items. Use this receipt when filing your taxes. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. It includes essential instructions for donors on how to fill out the. You should use this form when planning to donate items to goodwill for tax deduction purposes. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Goodwill donation receipt and instructions. Internal revenue service (irs) requires donors to value their items. Use this receipt when filing your taxes. Use this receipt when filing your taxes. A donor is responsible for valuing the donated. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. It provides a method to estimate the value of your donated goods accurately. Internal revenue service (irs) requires donors to value their items. This form serves as proof of the donation and is essential for donors who wish to. Some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. Description donor notes for tax records boxes bags clothing household furniture other tax year: A. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. But in this article, i’ll show you how to complete the donation. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. A donor is responsible for valuing the donated. Use this receipt when filing your taxes. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Description donor notes for tax records boxes bags clothing household furniture other tax year: To help guide you, goodwill industries international has compiled a list providing price. Use this receipt when filing your taxes. Goodwill donation receipt and instructions. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. Use this receipt when filing your taxes. This file provides a detailed donation receipt for contributions to goodwill. It includes essential instructions for donors on how to fill out the. Internal revenue service, establishing a dollar value on donated items is the responsibility. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Use this receipt when filing your taxes. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. A donor is. Goodwill donation receipt and instructions. This file provides a detailed donation receipt for contributions to goodwill. But in this article, i’ll show you how to complete the donation. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. Internal revenue service (irs) requires donors to value their items. You should use this form when planning to donate items to goodwill for tax deduction purposes. Internal revenue service (irs) requires donors to value their items. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. This file provides a detailed donation receipt for contributions to goodwill. A donor is responsible for valuing. Goodwill donation receipt and instructions. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual's taxes. But in this article, i’ll show you how to complete the donation. It includes essential instructions for donors on how to fill out the. Description donor notes for tax records boxes bags clothing household furniture. Use this receipt when filing your taxes. This form serves as proof of the donation and is essential for donors who wish to. Internal revenue service (irs) requires donors to value their items. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. A goodwill donation receipt form is a document provided by goodwill to donors after making a donation. A donor is responsible for valuing the donated. To help guide you, goodwill industries international has compiled a list providing price. You should use this form when planning to donate items to goodwill for tax deduction purposes. This file provides a detailed donation receipt for contributions to goodwill. It provides a method to estimate the value of your donated goods accurately. Internal revenue service, establishing a dollar value on donated items is the responsibility of the. Some goodwill donation centers can help you with your donation receipt and send an electronic copy to your email. Goodwill donation receipt and instructions. Use this receipt when filing your taxes.Fair Market Value Cincinnati Goodwill

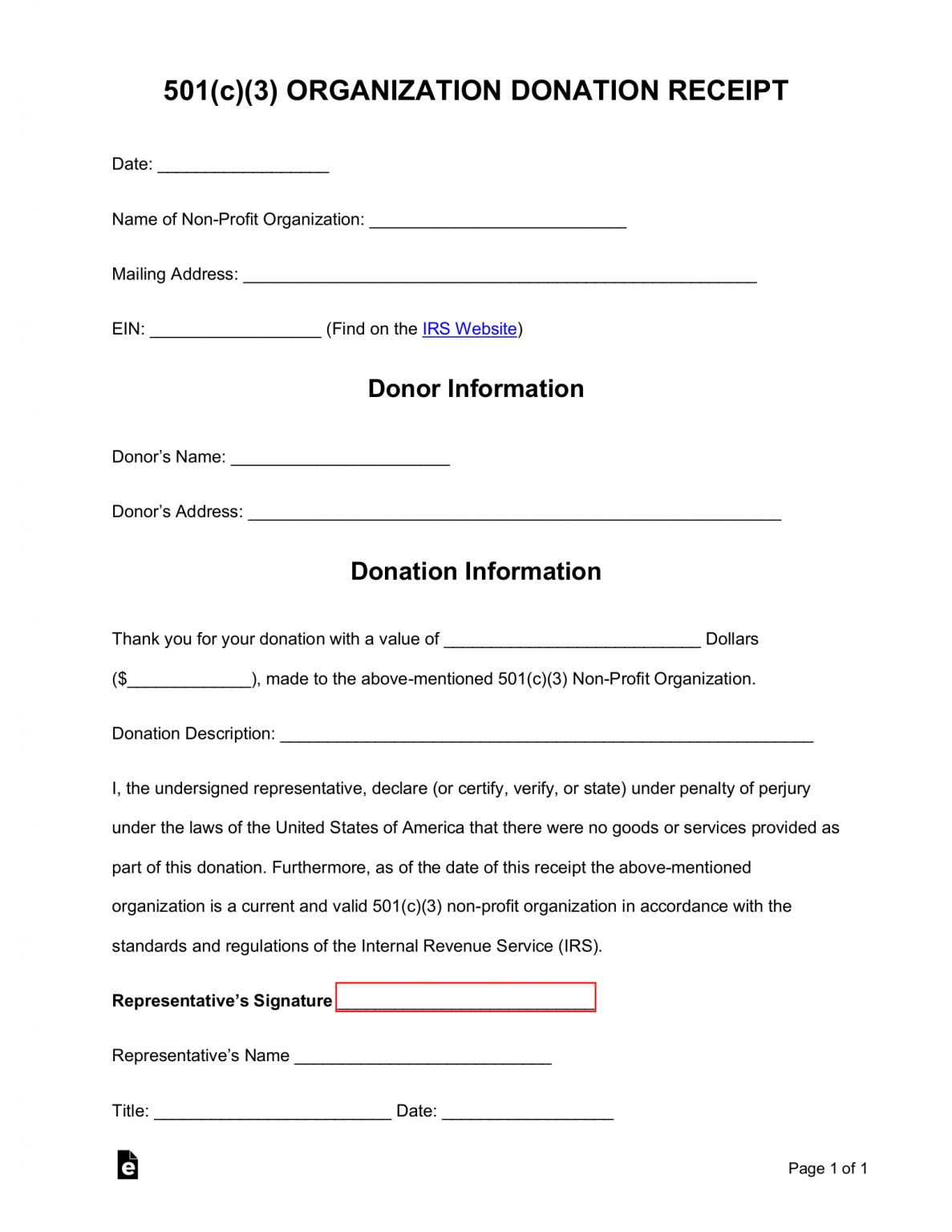

Free Donation Receipt Template PDF Word eForms

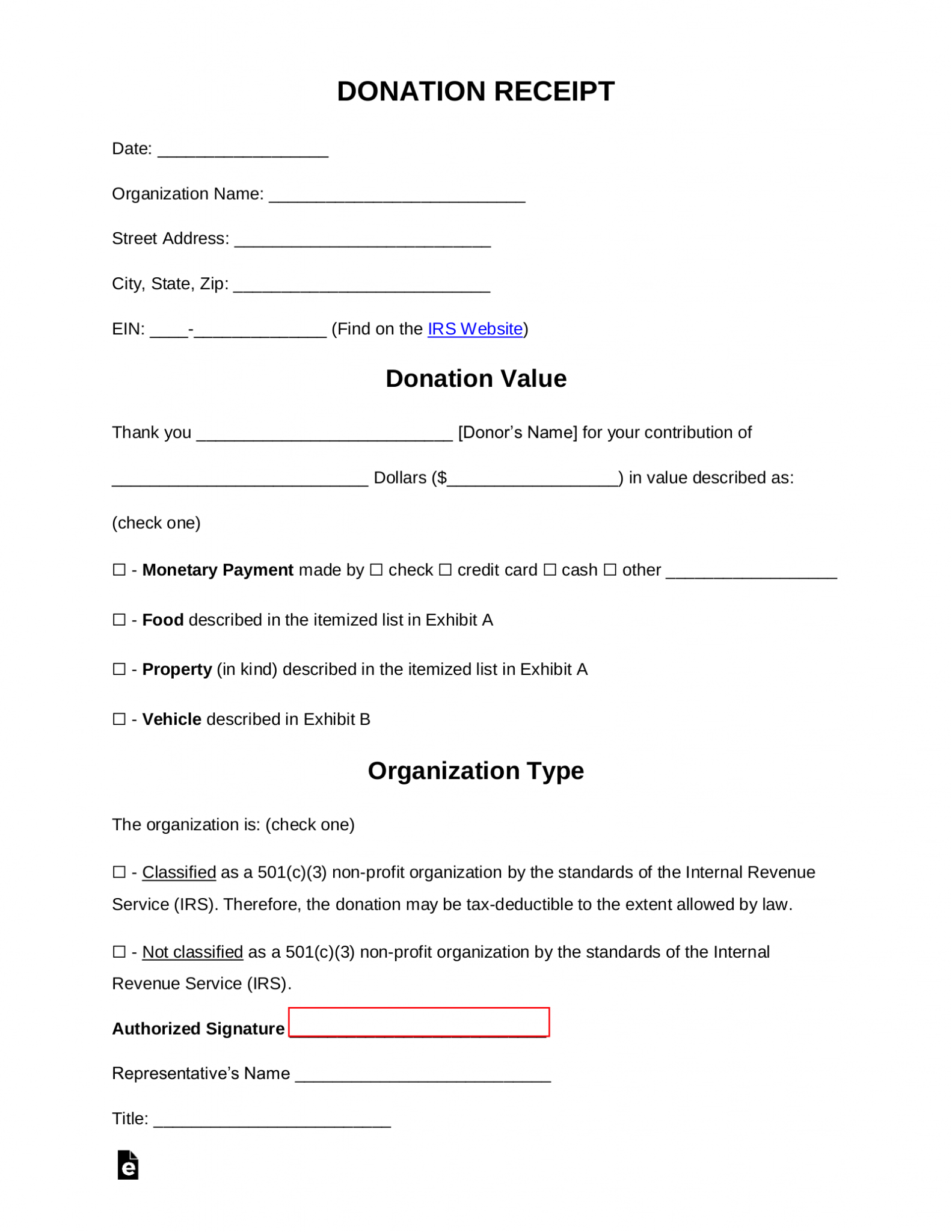

Free Goodwill Donation Receipt Template Pdf Eforms Sexiz Pix

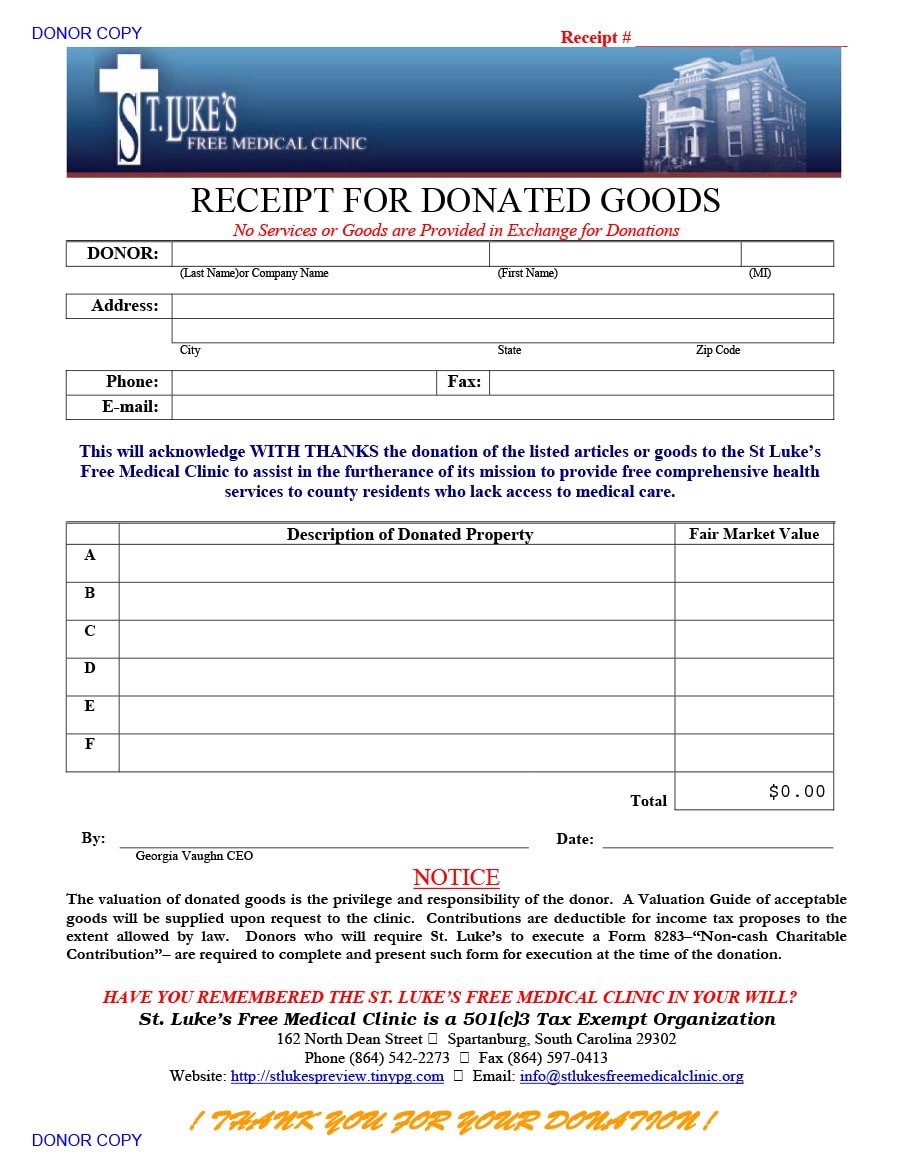

Printable Goodwill Donation Receipt

Used Goods Donation Value Calculator Goodwill of Greater Washington

Free Donation Receipt Template PDF Word eForms

Printable Goodwill Donation Receipt

Printable Goodwill Donation Form

free goodwill donation receipt template pdf eforms free goodwill

Goodwill Printable Donation Receipt, Ad access legal documents to help

A Donation Receipt Is Used To Claim A Tax Deduction For Clothing And Household Property Itemized On An Individual's Taxes.

It Includes Essential Instructions For Donors On How To Fill Out The.

But In This Article, I’ll Show You How To Complete The Donation.

Description Donor Notes For Tax Records Boxes Bags Clothing Household Furniture Other Tax Year:

Related Post: