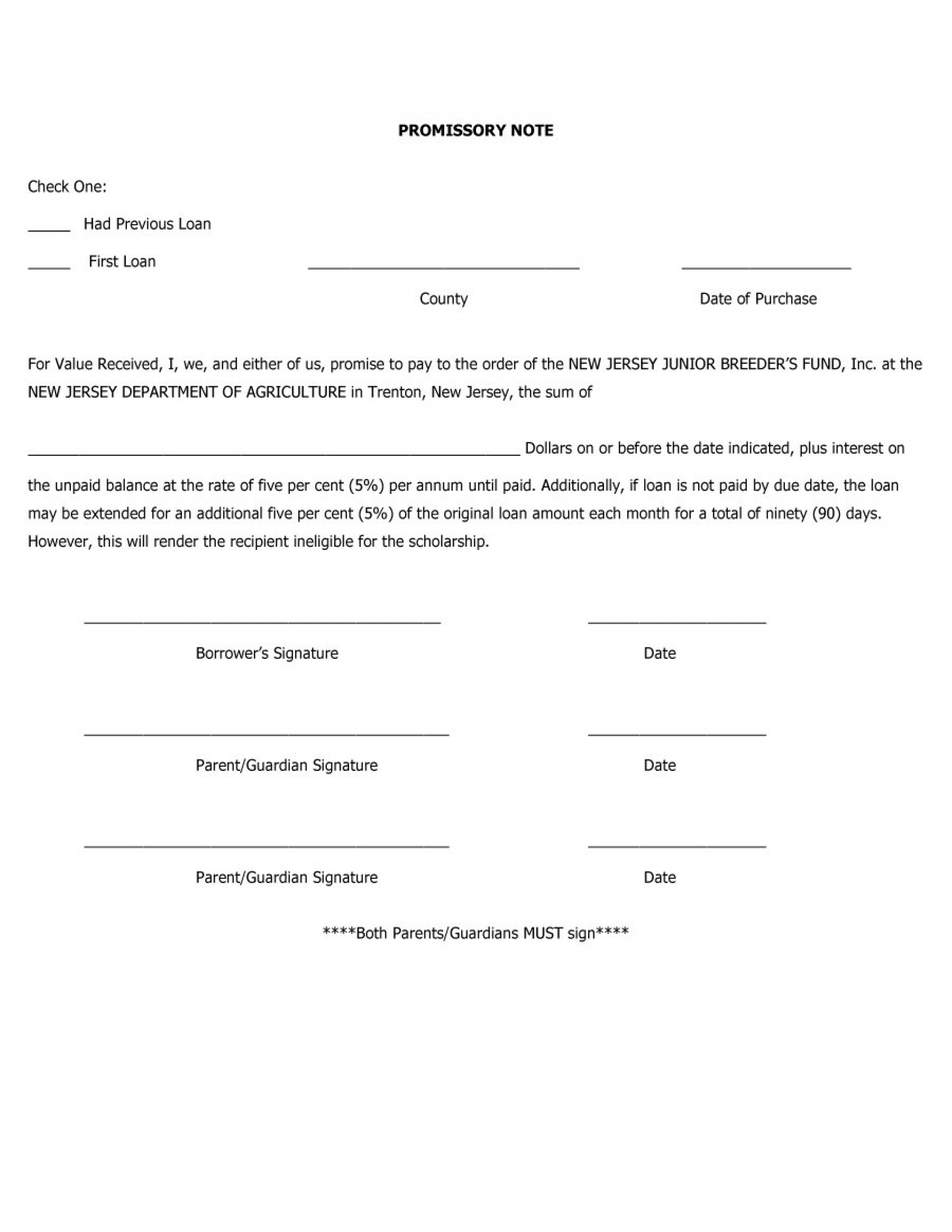

Free Printable Promissory Note

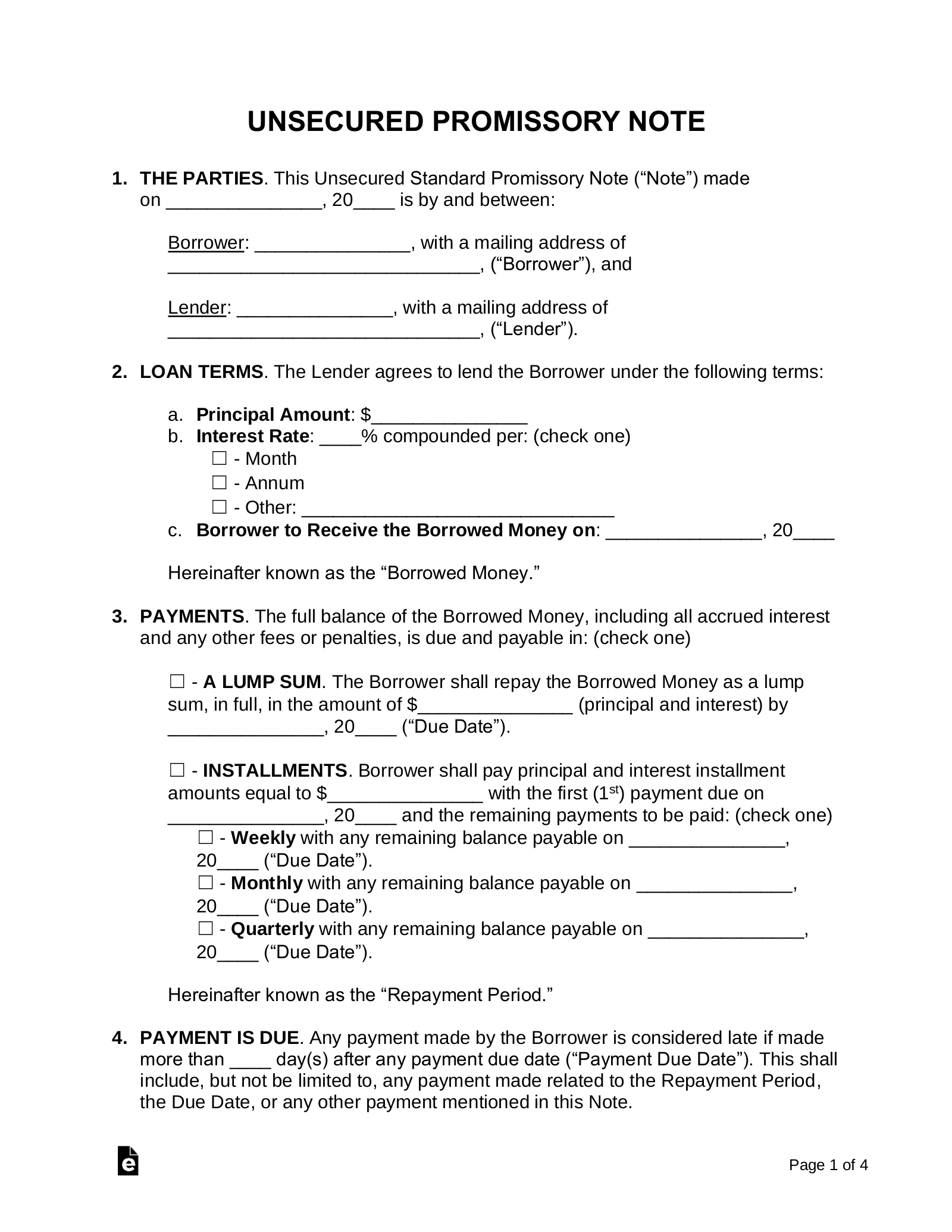

Free Printable Promissory Note - This simple yet powerful document fosters trust and accountability, helping prevent disputes. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. By using these promissory note templates, you are letting each person involved in the transaction know that it is a serious transaction and that payment needs to be paid back at the time specified. A promissory note is a written promise to pay back money owed within a specific timeframe. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. Below we analyze the promissory note, preparing one, and how usury laws apply to. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. A promissory note is a written promise to pay back money owed within a specific timeframe. Below we analyze the promissory note, preparing one, and how usury laws apply to. Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and personal finance. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. By using these promissory note templates, you are letting each person involved in the transaction know that it is a serious transaction and that payment needs to be paid back at the time specified. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. _____, with a mailing address of _____, (“borrower”), and lender: Below we analyze the promissory note, preparing one, and how usury laws apply to. People who cannot qualify to obtain mortgages to buy a home can still do so. This simple yet powerful document fosters trust and accountability, helping prevent disputes. _____, with a mailing address of _____, (“lender”). People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and. The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. _____, with a mailing address of _____, (“lender”). Promissory notes. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. _____, with a mailing address of _____, (“lender”). People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. _____, with a mailing address of _____, (“borrower”),. A promissory note is a written promise to pay back money owed within a specific timeframe. Below we analyze the promissory note, preparing one, and how usury laws apply to. This standard promissory note (“note”) made on _____, 20____ is by and between: _____, with a mailing address of _____, (“borrower”), and lender: The borrower receives the funds after the. This simple yet powerful document fosters trust and accountability, helping prevent disputes. Unlike an iou that only acknowledges a debt amount, a promissory note details the consequences of failing to repay a loan. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with,. Below we analyze the promissory note, preparing one, and how usury laws apply to. _____, with a mailing address of _____, (“lender”). A promissory note is a written promise to pay back money owed within a specific timeframe. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for. A promissory note can be a big benefit if you are worried about the repayment of a loan. Promissory notes protect the contractual relationship between the lender and the borrower and are essential debt instruments in businesses and personal finance. _____, with a mailing address of _____, (“lender”). A promissory note is a written promise to pay back money owed. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. Below we analyze the promissory note, preparing one, and how usury laws apply to. _____, with a mailing address of _____, (“lender”). By using these promissory note templates, you are letting each person involved in the transaction know that it is a. By using these promissory note templates, you are letting each person involved in the transaction know that it is a serious transaction and that payment needs to be paid back at the time specified. People who cannot qualify to obtain mortgages to buy a home can still do so using a promissory note template. A promissory note offers clarity and. A promissory note can be a big benefit if you are worried about the repayment of a loan. _____, with a mailing address of _____, (“lender”). This simple yet powerful document fosters trust and accountability, helping prevent disputes. This standard promissory note (“note”) made on _____, 20____ is by and between: A promissory note is a written promise to pay back money owed within a specific timeframe. The full balance of this note, including all accrued interest and late fees, is due and payable on the ___ day of _______________, 20___, hereinafter known as the due date. Below we analyze the promissory note, preparing one, and how usury laws apply to. You will be able to use the promissory note to govern repayment, to make sure that you can take the collateral that the loan is secured with, or to help establish a. The borrower receives the funds after the note is signed and agrees to make payments under the terms and conditions of the note. A promissory note offers clarity and protection by outlining loan terms such as repayment schedules, interest rates, and collateral. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. These templates can be edited to add all the information you need giving it a professional look and keeping the locations for signatures open. _____, with a mailing address of _____, (“borrower”), and lender:Free Unsecured Promissory Note Template PDF Word eForms

Printable Simple Promissory Note Template

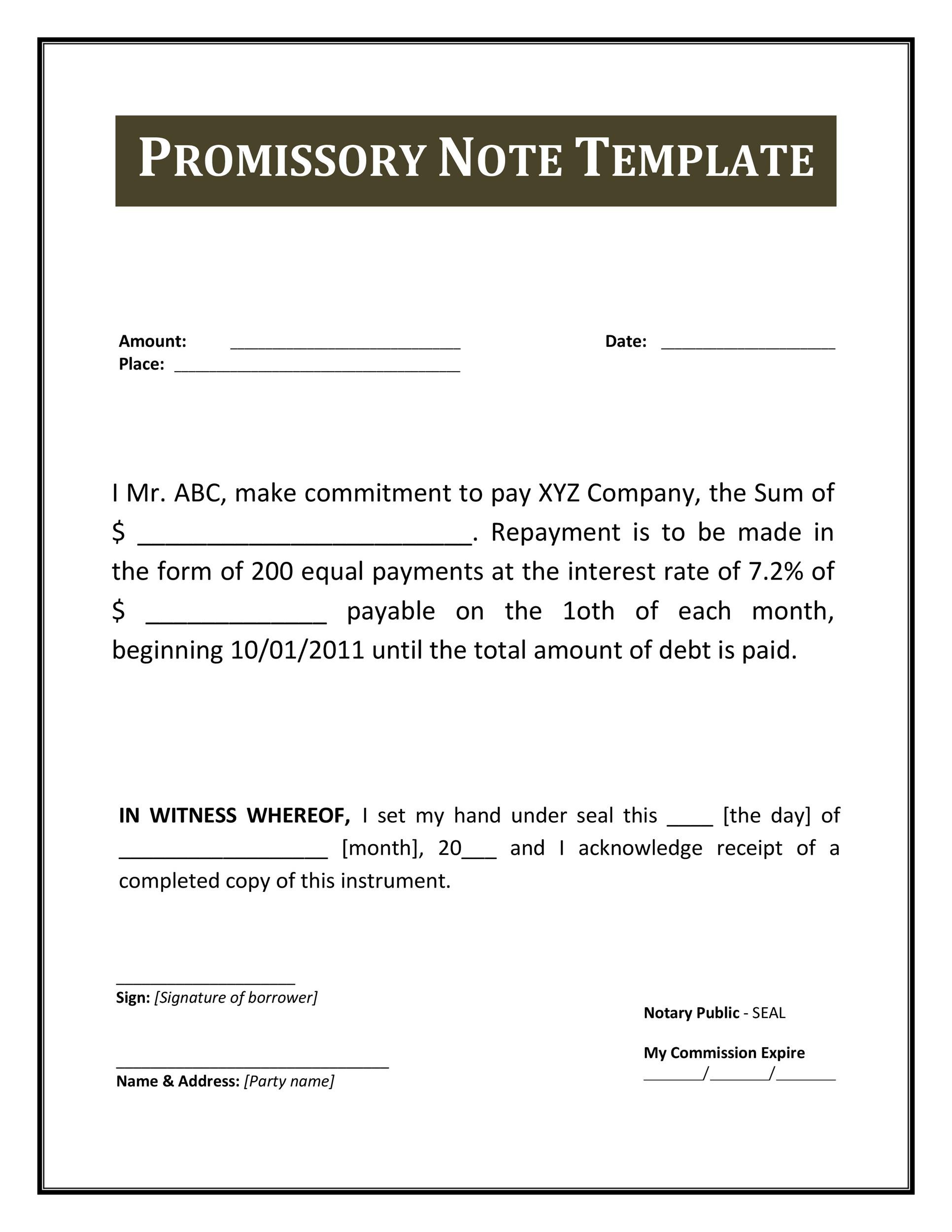

Printable Promissory Note Template

Promissory Note Word Template

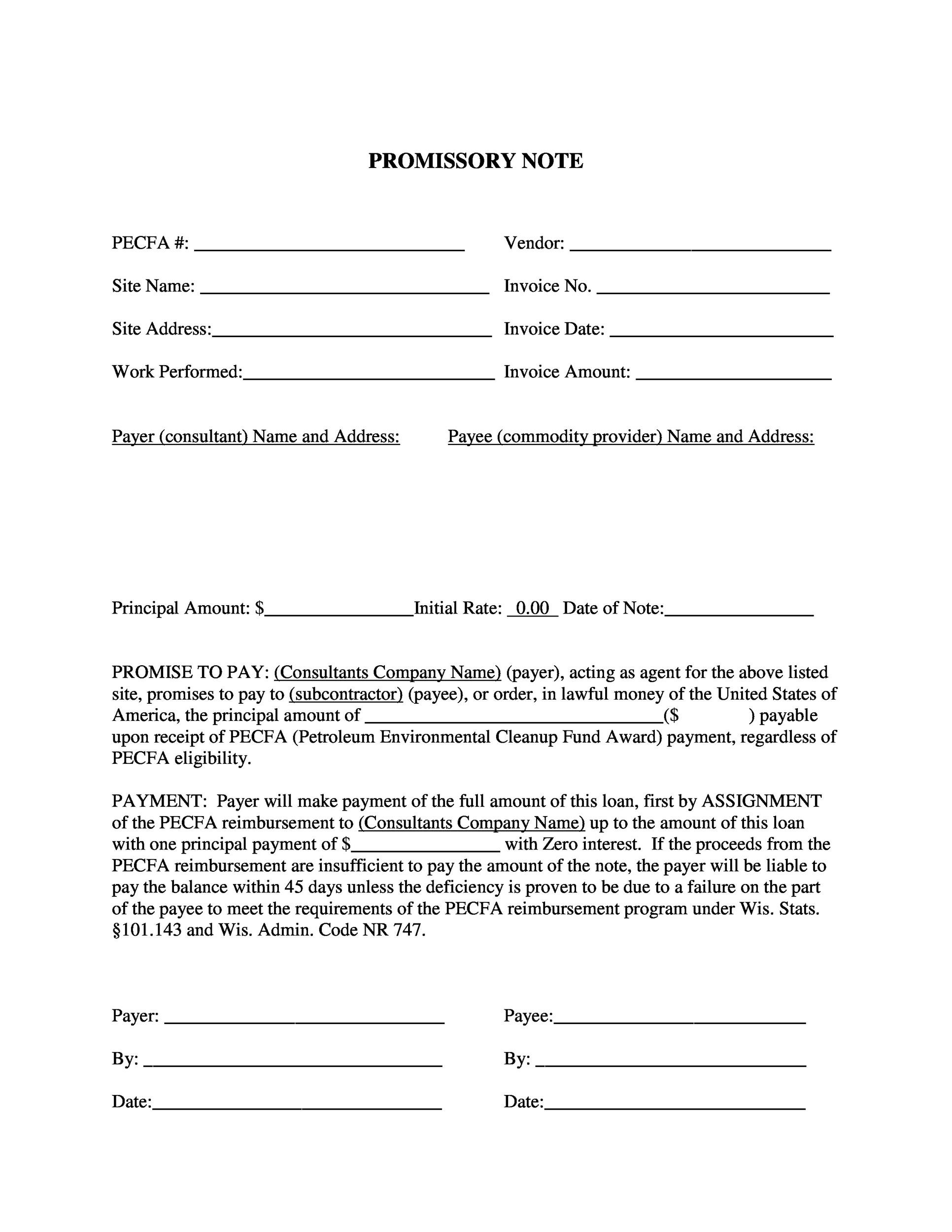

Promissory Loan Agreement Template

Free Printable Promissory Note For Personal Loan Free Printable

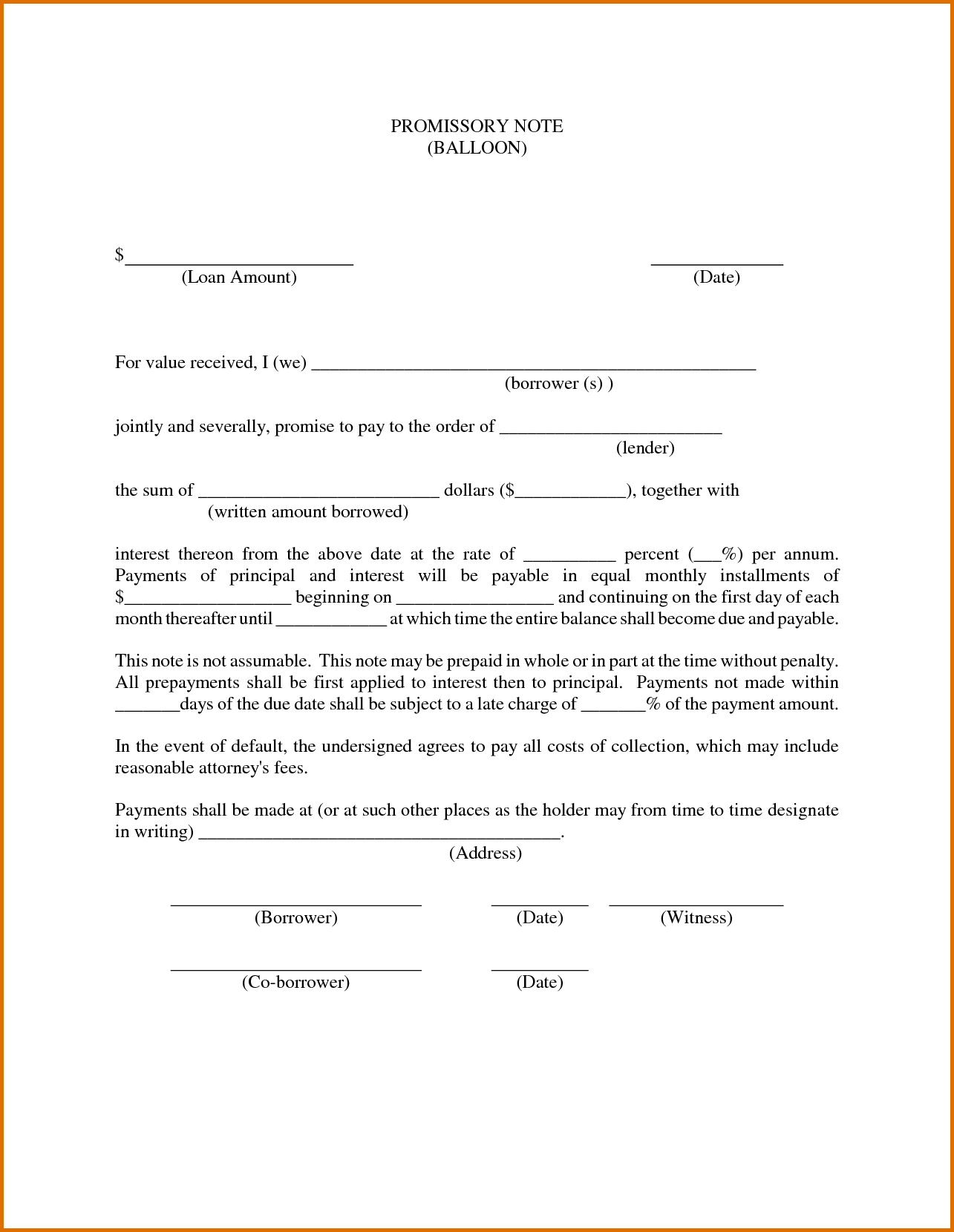

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

sample free promissory note loan release form word pdf florida

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Promissory Notes Protect The Contractual Relationship Between The Lender And The Borrower And Are Essential Debt Instruments In Businesses And Personal Finance.

By Using These Promissory Note Templates, You Are Letting Each Person Involved In The Transaction Know That It Is A Serious Transaction And That Payment Needs To Be Paid Back At The Time Specified.

People Who Cannot Qualify To Obtain Mortgages To Buy A Home Can Still Do So Using A Promissory Note Template.

Unlike An Iou That Only Acknowledges A Debt Amount, A Promissory Note Details The Consequences Of Failing To Repay A Loan.

Related Post:

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-34.jpg)