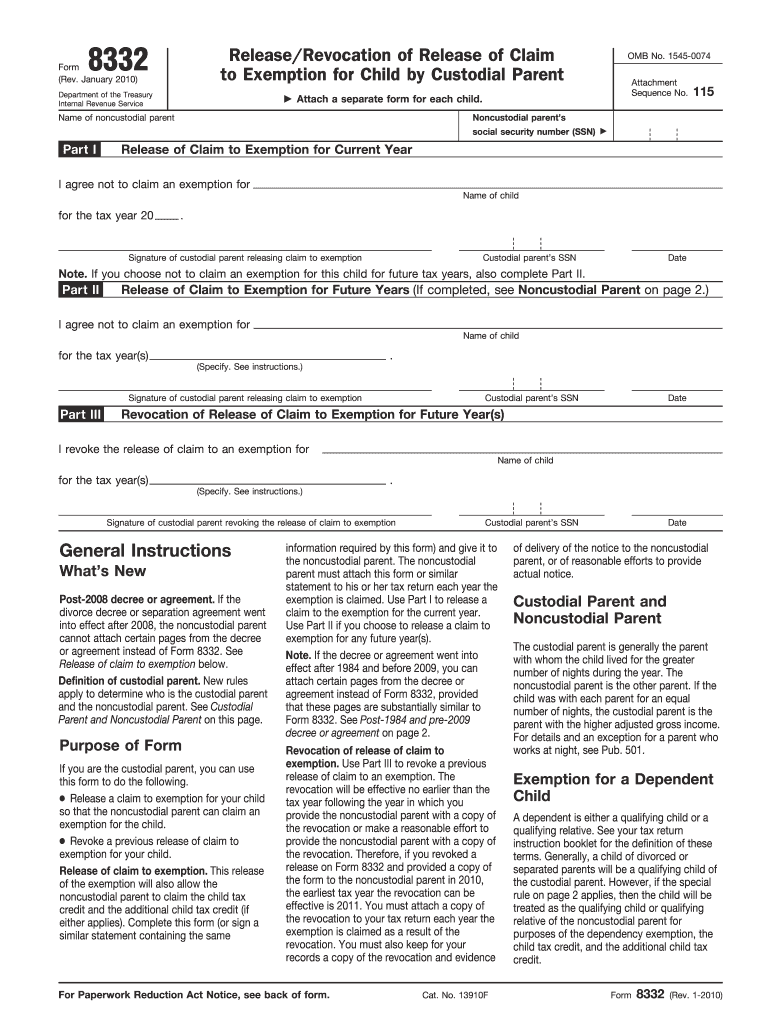

Form 8332 Printable

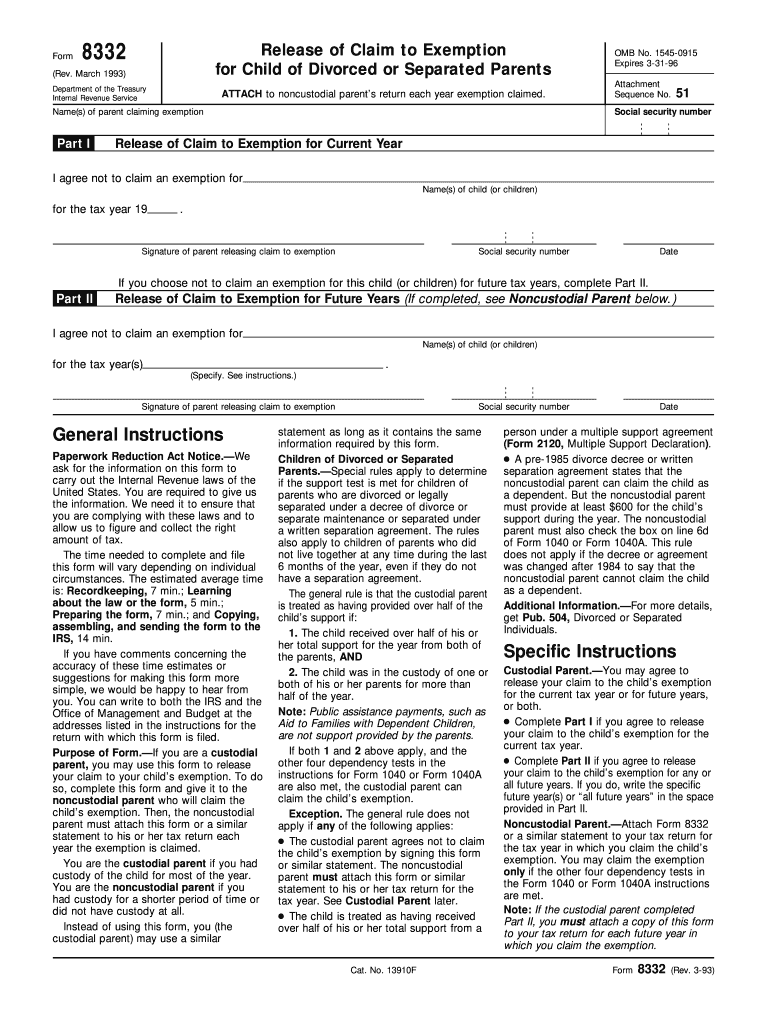

Form 8332 Printable - If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you want a pdf, make sure your printer setting options are set for pdf. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of divorced or separated parents. See form 8453 and its instructions for more details. The form isn't listed in the client form list. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. If you, your spouse, and the child all live in the same household all year, you do not need form 8332. Electronically, you must file form 8332 with form 8453, u.s. The release of the dependency exemption will also release to the. You can also print a copy of form 8453 here: Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. Form 8332 is generally attached to the claimant's tax return. If you want a pdf, make sure your printer setting options are set for pdf. You can also print a copy of form 8453 here: If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form. That form is for situations where the parents live separately, the child. The release of the dependency exemption will also release to the. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. Right click on the tab for the form and click on print. Electronically, you must file form 8332 with form 8453, u.s. The release of the dependency exemption will also release to the. If you are the custodial parent (for a child), you can use irs form 8332, release/revocation of release of claim to exemption for child by custodial parent... The form isn't listed in the client form list. This form is particularly relevant for separated or. The release of the dependency exemption will also release to the. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. Use form 8332 when a custodial parent agrees to release a claim to a. You can also print a copy of form 8453 here: If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. Use form 8332. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. The release of the dependency exemption will also release. That form is for situations where the parents live separately, the child. This form is particularly relevant for separated or. You can also print a copy of form 8453 here: Form 8332 is generally attached to the claimant's tax return. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this. That form is for situations where the parents live separately, the child. Form 8332 is generally attached to the claimant's tax return. See form 8453 and its instructions for more details. This form is particularly relevant for separated or. If you, your spouse, and the child all live in the same household all year, you do not need form 8332. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. This form is particularly relevant for separated or. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. That form is. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. Form 8332 is generally attached to the claimant's tax return. You can also print a copy of form 8453 here: The release of the dependency exemption will also release to the. If you, your spouse, and the child all live in the. To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. If you want a pdf, make sure your. Once you indicate in turbotax that you have a form 8332, a form 8453 will generate for printing. Electronically, you must file form 8332 with form 8453, u.s. The release of the dependency exemption will also release to the. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent,. This form is particularly relevant for separated or. Right click on the tab for the form and click on print. Form 8332 is generally attached to the claimant's tax return. Download or print the 2024 federal form 8332 (release/revocation of release of claim to exemption for child by custodial parent) for free from the federal internal revenue service. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and. See form 8453 and its instructions for more details. Use form 8332 when a custodial parent agrees to release a claim to a child's tax exemption for the noncustodial parent, especially following a divorce or separation. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Electronically, you must file form 8332 with form 8453, u.s. You can also print a copy of form 8453 here: To claim the earned income credit on your taxes using irs form 8332, you must meet the eligibility requirements for the credit and provide the necessary information on the form. If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of divorced or separated parents. The release of the dependency exemption will also release to the. That form is for situations where the parents live separately, the child. If you, your spouse, and the child all live in the same household all year, you do not need form 8332.Irs Form 8332 Printable

Tax Form 8332 Printable

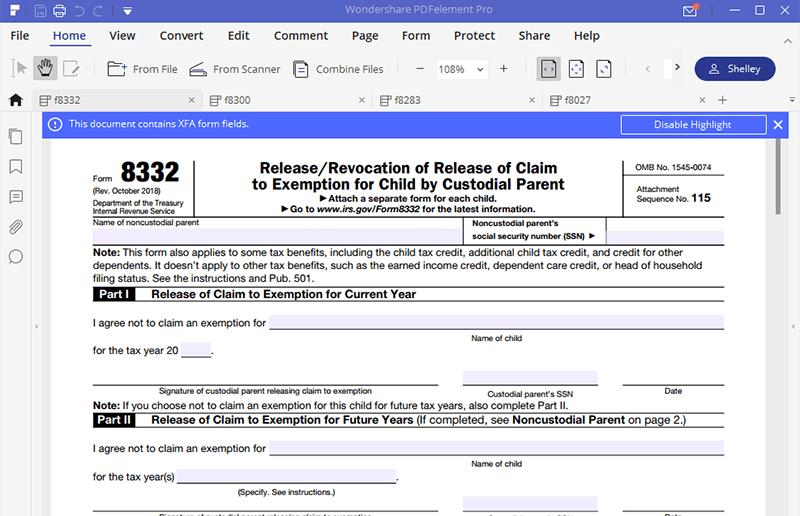

IRS Form 8332 Fill it with the Best PDF Form Filler

Irs Form 8332 Fillable

Tax Form 8332 Printable

Tax Form 8332 Printable

IRS Form 8332 Fill it with the Best PDF Form Filler

Tax Form 8332 Printable

Ir's Form 8332 Fill Out and Sign Printable PDF Template airSlate

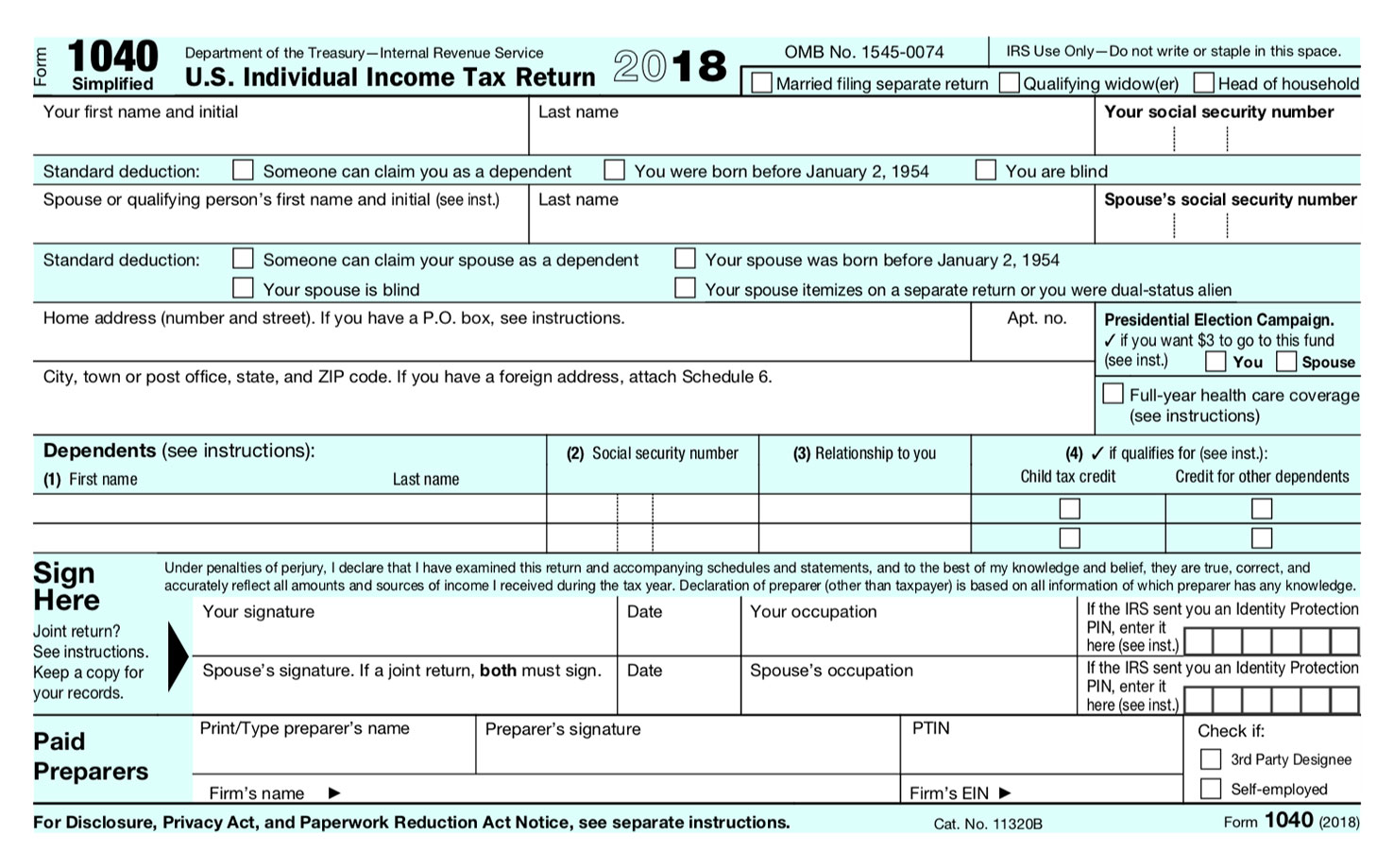

Simplified Tax Form? NESA

If You Want A Pdf, Make Sure Your Printer Setting Options Are Set For Pdf.

The Form 8332 Can Be Found Here:

If You Are The Custodial Parent (For A Child), You Can Use Irs Form 8332, Release/Revocation Of Release Of Claim To Exemption For Child By Custodial Parent..

The Form Isn't Listed In The Client Form List.

Related Post: