Debt Snowball Printable

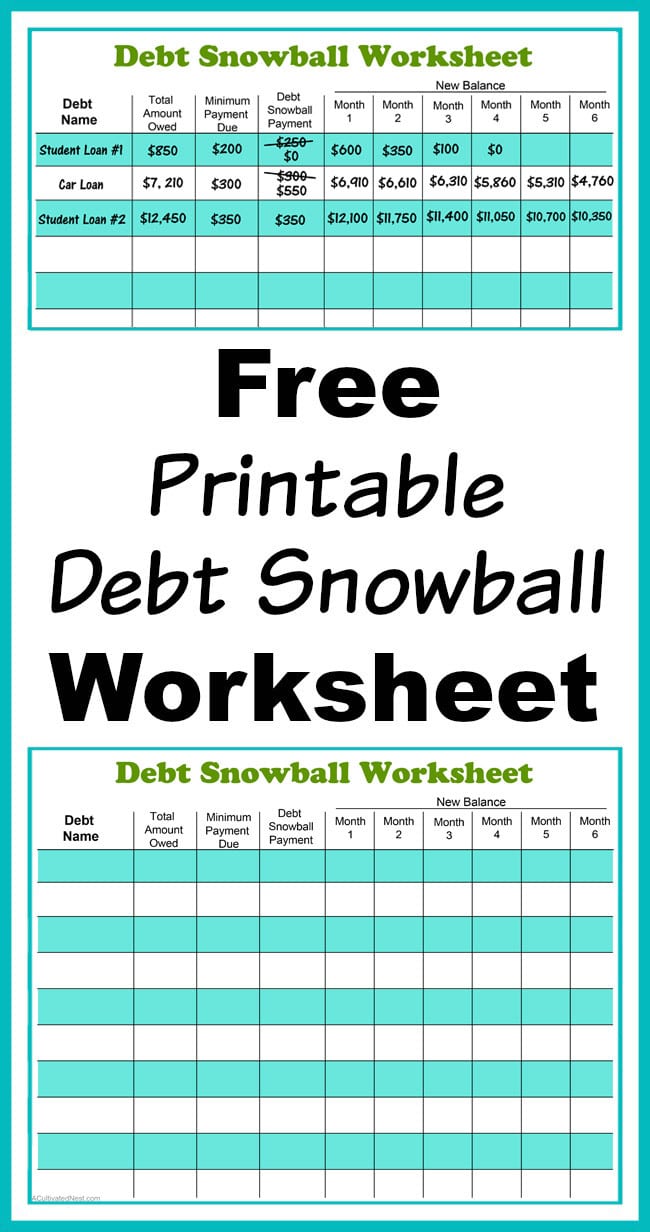

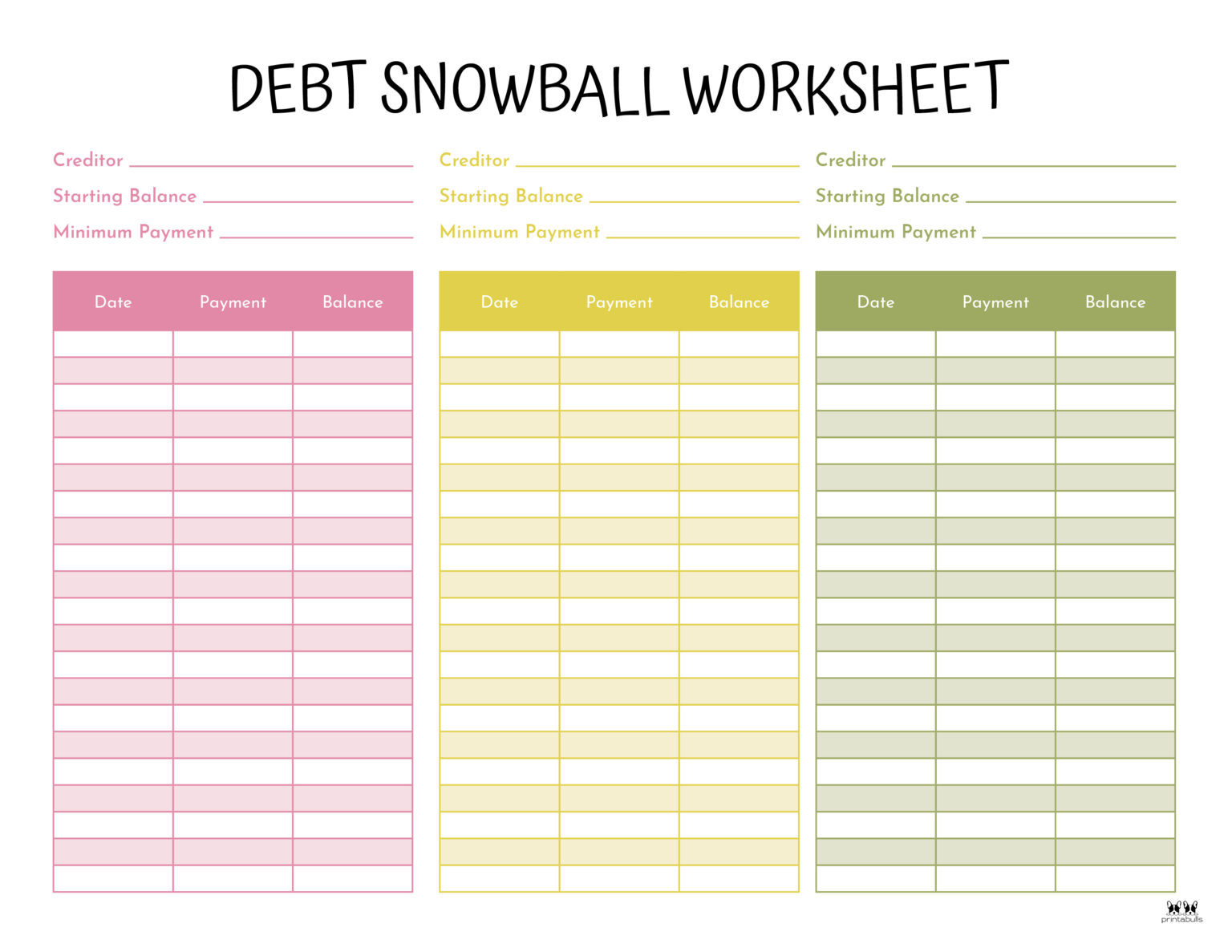

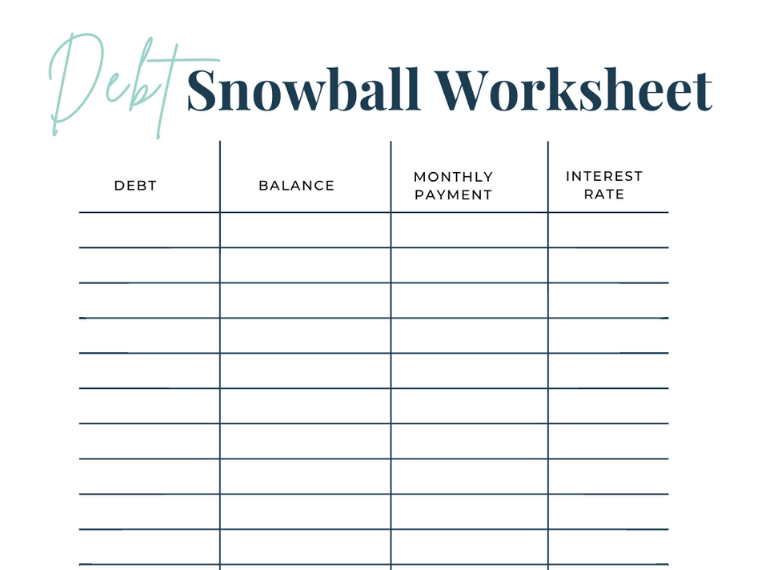

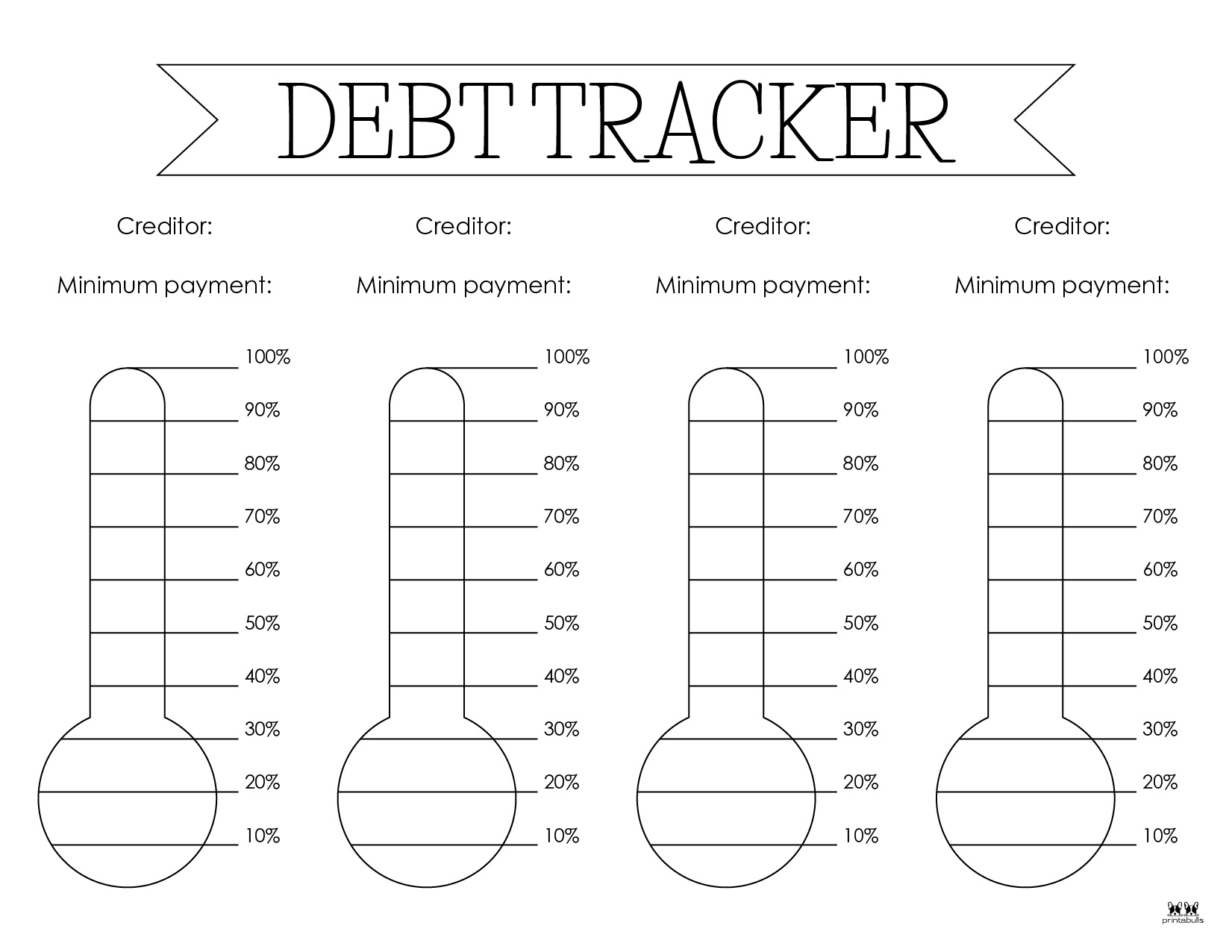

Debt Snowball Printable - A debt snowball tracker printable sheet is a simple yet effective tool that allows individuals to track their debt payments and stay on top of their finances. Take control of your finances and achieve your financial goals faster with this powerful debt payoff method. When you pay off the smallest debt, add that minimum payment amount to. The debt snowball allows you to make a simple change to your behavior and systematically pay off debt at an accelerated rate. With clear progress tracking, smart payment strategies like the snowball method, and simple scheduling, you’ll turn loan payments into easy habits. Download your free copy of our debt snowball worksheet. Watch your debt shrink, stay motivated,. This is the ultimate guide to debt snowball method! Available as printable pdf or google docs sheet. The debt snowball is one of the best ways to make a big dent. The debt snowball allows you to make a simple change to your behavior and systematically pay off debt at an accelerated rate. A debt snowball tracker printable sheet is a simple yet effective tool that allows individuals to track their debt payments and stay on top of their finances. These free printable pdf debt snowbal concept worksheets will help you track your progress through dave ramsey's debt snowball method. Watch your debt shrink, stay motivated,. The debt snowball method is all about paying. Find 35 pages of debt trackers to help you pay off your debts faster and easier. It helps a person who owes multiple accounts pay off the smallest. Take control of your finances and achieve your financial goals faster with this powerful debt payoff method. Download your free copy of our debt snowball worksheet. List down all your debts and arrange them from the biggest to the smallest. Pay the minimum payment on every debt except the smallest. There are 11 different debt trackers to choose from, all in easy to download and print pdf format. When you pay off the smallest debt, add that minimum payment amount to. This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. How. Take control of your finances and achieve your financial goals faster with this powerful debt payoff method. A debt snowball tracker printable template is a powerful tool designed to assist individuals in managing and paying off their debts efficiently. This is the ultimate guide to debt snowball method! Use it to automaticaly create a debt repayment plan using the debt. Find 35 pages of debt trackers to help you pay off your debts faster and easier. A debt snowball tracker printable template is a powerful tool designed to assist individuals in managing and paying off their debts efficiently. When you pay off the smallest debt, add that minimum payment amount to. Use it to automaticaly create a debt repayment plan. These free printable pdf debt snowbal concept worksheets will help you track your progress through dave ramsey's debt snowball method. How to download and use the printable debt snowball trackers. It helps a person who owes multiple accounts pay off the smallest. Take control of your finances and achieve your financial goals faster with this powerful debt payoff method. With. Available as printable pdf or google docs sheet. This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Download your free copy of our debt snowball worksheet. Watch your debt shrink, stay motivated,. A debt snowball tracker printable template is a powerful tool designed to assist individuals in managing and paying off. Pay the minimum payment on every debt except the smallest. The debt snowball method is all about paying. Watch your debt shrink, stay motivated,. This is the ultimate guide to debt snowball method! By using a printable sheet, individuals. By using a printable sheet, individuals. The debt snowball allows you to make a simple change to your behavior and systematically pay off debt at an accelerated rate. How to download the free debt snowball printable kit. List down all your debts and arrange them from the biggest to the smallest. Say goodbye to debt with our free, printable debt. Download your free copy of our debt snowball worksheet. Watch your debt shrink, stay motivated,. Pay the minimum payment on every debt except the smallest. With clear progress tracking, smart payment strategies like the snowball method, and simple scheduling, you’ll turn loan payments into easy habits. The debt snowball method is all about paying. Take control of your finances and achieve your financial goals faster with this powerful debt payoff method. Download your free copy of our debt snowball worksheet. Say goodbye to debt with our free, printable debt snowball template! Just use a debt payoff spreadsheet or a debt snowball worksheet. Watch your debt shrink, stay motivated,. It helps a person who owes multiple accounts pay off the smallest. Watch your debt shrink, stay motivated,. The debt snowball method is all about paying. A debt snowball tracker printable sheet is a simple yet effective tool that allows individuals to track their debt payments and stay on top of their finances. This free printable debt snowball worksheet set. Pay as much money as possible to the smallest debt. The debt snowball is one of the best ways to make a big dent. A debt snowball tracker printable template is a powerful tool designed to assist individuals in managing and paying off their debts efficiently. The debt snowball method is all about paying. Pay the minimum payment on every debt except the smallest. How to download the free debt snowball printable kit. Take control of your finances and achieve your financial goals faster with this powerful debt payoff method. These free printable pdf debt snowbal concept worksheets will help you track your progress through dave ramsey's debt snowball method. Available as printable pdf or google docs sheet. There are 11 different debt trackers to choose from, all in easy to download and print pdf format. This is the ultimate guide to debt snowball method! This free printable debt snowball worksheet set will make paying down your debt simple and easy to understand. Then start your debt snowball by. List down all your debts and arrange them from the biggest to the smallest. The debt snowball allows you to make a simple change to your behavior and systematically pay off debt at an accelerated rate. It helps a person who owes multiple accounts pay off the smallest.Debt Trackers & Debt Snowball Worksheets 35 Pages PrintaBulk

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Free Printable Debt Snowball Worksheet Pay Down Your Debt —

Debt Snowball Tracker Printable, Debt Free Chart, Debt Payoff Worksheet

The Debt Snowball Method A Complete Guide With Free Printables Free

Debt Trackers & Debt Snowball Worksheets 35 Pages Printabulls

Debt Snowball Tracker Printable Debt Payment Worksheet Debt Payoff

Debt Trackers & Debt Snowball Worksheets 35 Pages PrintaBulk

Free Printable Debt Snowball Worksheet To Payoff Debt In 2022

Debt Trackers & Debt Snowball Worksheets 35 Pages PrintaBulk

Find 35 Pages Of Debt Trackers To Help You Pay Off Your Debts Faster And Easier.

With Clear Progress Tracking, Smart Payment Strategies Like The Snowball Method, And Simple Scheduling, You’ll Turn Loan Payments Into Easy Habits.

Use It To Automaticaly Create A Debt Repayment Plan Using The Debt Snowball Methods.

Use This Debt Snowball Worksheet To Stay Organized And Track The Progress Of Your Own Debt Payment.

Related Post:

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball-724x1024.jpg)